As we navigate through the uncertainties of traveling during the COVID-19 era, having the right travel insurance becomes more essential than ever. This guide will delve into the intricacies of travel insurance coverage specifically tailored for COVID-19 related issues, exploring its importance, types of coverage, considerations when purchasing, and the claims process.

Importance of Travel Insurance During COVID-19

Travel insurance plays a crucial role during the COVID-19 pandemic as it provides essential coverage and protection for travelers facing uncertainties and disruptions caused by the virus. It is more important than ever to have adequate travel insurance to ensure peace of mind and financial security while traveling.

Protection Against Trip Cancellation or Interruption

Travel insurance can safeguard travelers in case they need to cancel or cut short their trip due to COVID-19-related reasons, such as falling ill with the virus, travel restrictions, or quarantine requirements. It can cover non-refundable expenses like flights, accommodation, and tour bookings, providing reimbursement for these costs.

Emergency Medical Coverage

In the event of contracting COVID-19 or any other illness while traveling, having travel insurance with medical coverage is essential. It can cover medical expenses, hospitalization, and emergency medical evacuation, ensuring that travelers receive the necessary care without worrying about high healthcare costs.

Financial Protection for Travel Delays

Travel insurance can offer compensation for additional expenses incurred due to flight cancellations, delays, or missed connections caused by the pandemic. This coverage can include reimbursement for accommodation, meals, and transportation arrangements, reducing the financial impact of unexpected travel disruptions.

Assistance Services and 24/7 Support

Many travel insurance policies provide access to assistance services and round-the-clock support for travelers in need of help during their trip. This can include medical advice, emergency travel arrangements, and coordination of services in case of COVID-19 emergencies, ensuring that travelers receive immediate assistance and guidance.

Coverage for Additional COVID-19 Expenses

Some travel insurance plans offer coverage for specific COVID-19-related expenses, such as costs associated with mandatory testing, quarantine accommodation, or repatriation due to border closures. Having this coverage can alleviate financial burdens and ensure that travelers are adequately protected against unforeseen circumstances related to the pandemic.

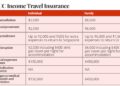

Types of Travel Insurance Coverage for COVID-19

Travel insurance coverage for COVID-19 has become increasingly important in light of the ongoing pandemic. Various types of coverage are now being offered by insurance providers to address the specific concerns related to COVID-19 during travel.

Quarantine Coverage

- Some travel insurance policies now include coverage for quarantine expenses in case you test positive for COVID-19 during your trip.

- This coverage may include costs for accommodations, meals, and other necessary expenses during the quarantine period.

- It is important to check the specific terms and conditions of the policy to understand the extent of coverage provided.

Trip Cancellation or Interruption due to COVID-19

- Many insurance providers offer coverage for trip cancellation or interruption if you or a family member contract COVID-19 before or during your trip.

- This coverage can help reimburse you for non-refundable expenses such as flights, accommodations, and other prepaid costs.

- Be sure to review the policy details to understand the eligibility criteria and documentation required to make a claim.

Emergency Medical Coverage for COVID-19

- Some travel insurance plans now include coverage for emergency medical expenses related to COVID-19 while traveling abroad.

- This coverage may include hospitalization, medical treatment, and evacuation costs in case you contract the virus during your trip.

- It is essential to verify the coverage limits and any exclusions related to pre-existing conditions before purchasing the policy.

COVID-19 Testing Coverage

- With the increased emphasis on COVID-19 testing requirements for travel, some insurance providers offer coverage for the costs of mandatory testing.

- This coverage may apply to pre-departure testing, testing upon arrival at your destination, or any other required testing during your trip.

- Check the policy details to understand the specific types of testing covered and the reimbursement process.

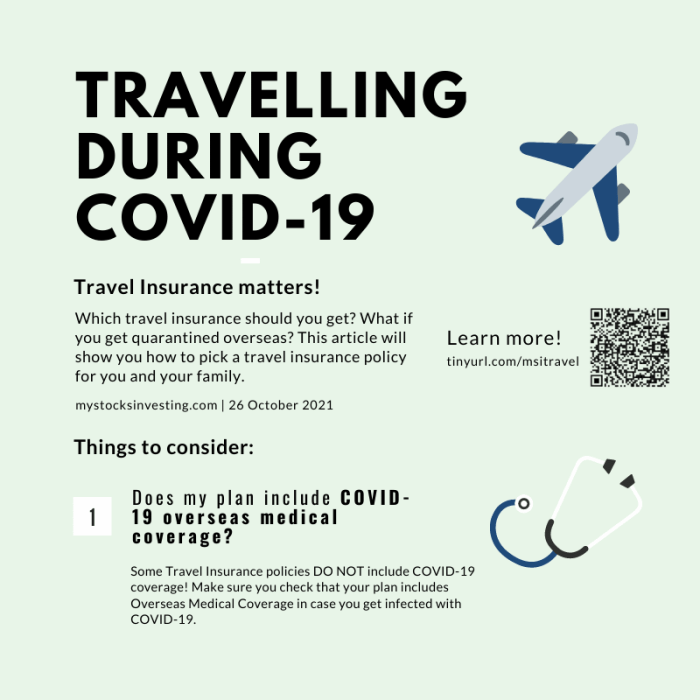

Considerations When Purchasing Travel Insurance for COVID-19

When purchasing travel insurance specifically for COVID-19 coverage, there are several key factors that you should consider to ensure you have adequate protection during your trip. It is important to carefully review the policy details to understand the coverage and limitations related to COVID-19.

Checklist for Reviewing Travel Insurance Policy

- Ensure that the policy provides coverage for trip cancellations or interruptions due to COVID-19-related reasons, such as illness or travel restrictions.

- Check if the policy includes coverage for emergency medical expenses related to COVID-19, including testing and treatment abroad.

- Review the policy to see if it offers coverage for quarantine expenses in case you are required to quarantine during your trip.

- Verify the coverage for emergency medical evacuation in case you need to be transported to a different location for treatment due to COVID-19.

- Check if the policy includes coverage for trip delays or additional accommodation expenses due to COVID-19-related reasons.

Limitations and Exclusions to be Aware of

It is important to note that most travel insurance policies have limitations and exclusions when it comes to COVID-19 coverage. Make sure to review the policy carefully to understand any restrictions that may apply.

- Some policies may not cover pre-existing medical conditions related to COVID-19, so it is essential to check this exclusion.

- Travel insurance may not provide coverage if you choose to travel against government advisories or warnings related to COVID-19.

- Check if the policy excludes coverage for cancellations or interruptions due to fear of traveling or general disinclination to travel during the pandemic.

Claims Process for COVID-19 Related Issues with Travel Insurance

When it comes to filing a claim for COVID-19 related issues with travel insurance, it's essential to understand the steps involved, tips for streamlining the process, and the documentation required.

Steps to File a Claim for COVID-19 Related Issues

- Contact your travel insurance provider as soon as possible to inform them of the situation and initiate the claims process.

- Follow the instructions provided by your insurance company on how to submit the claim, whether online or through other means.

- Provide all necessary documentation, such as medical reports, test results, travel itineraries, and receipts for expenses incurred due to COVID-19.

- Cooperate with the insurance company's investigation and provide any additional information they may request.

- Wait for the claim to be processed and keep track of its status through regular communication with the insurance provider.

Tips to Streamline the Claims Process for COVID-19 Related Incidents

- Keep all relevant documents organized and easily accessible to ensure a smooth and efficient claims process.

- Submit the required paperwork promptly to avoid delays in processing your claim.

- Stay in communication with your insurance provider and promptly respond to any requests for additional information.

- Be thorough in documenting all expenses related to the COVID-19 incident to provide comprehensive proof for your claim.

- Follow up regularly on the status of your claim to stay informed and address any issues promptly.

Documentation Required When Filing a Claim for COVID-19 with Travel Insurance

- Medical reports confirming the diagnosis of COVID-19 and the need for treatment.

- Test results showing a positive COVID-19 infection.

- Travel itineraries and booking confirmations to establish the timeline of events.

- Receipts for medical expenses, quarantine accommodation, and other costs incurred due to COVID-19.

- Any other relevant documentation requested by your insurance provider to support your claim.

Closure

In conclusion, ensuring you have adequate travel insurance coverage for COVID-19 can provide peace of mind and financial protection during your travels. By understanding the nuances of travel insurance in the context of the pandemic, you can make informed decisions to safeguard your health and travel plans.

Essential Questionnaire

What specific benefits does travel insurance provide for COVID-19 related issues?

Travel insurance can cover trip cancellations due to COVID-19, emergency medical expenses related to the virus, and quarantine accommodation costs.

How does travel insurance coverage for COVID-19 differ from traditional travel insurance?

Travel insurance for COVID-19 includes specific coverage for pandemic-related issues such as trip cancellations due to illness and medical expenses if infected during the trip.

What key factors should I consider when choosing a travel insurance policy that covers COVID-19?

Key factors include coverage for trip cancellations due to COVID-19, emergency medical coverage for the virus, and coverage for quarantine expenses.

What documentation may be required when filing a claim for COVID-19 with travel insurance?

Documentation may include medical reports confirming COVID-19 diagnosis, receipts for medical expenses, and proof of trip cancellation due to the virus.