Embark on a journey through the world of COVID-19 travel insurance, exploring its significance, coverage, benefits, and real-life scenarios. Get ready for an informative ride!

Delve into the various types of COVID-19 travel insurance, from single-trip to annual coverage, and discover how to choose the right plan for your needs.

Introduction to COVID-19 Travel Insurance

Traveling during the COVID-19 pandemic comes with its own set of risks and uncertainties. To mitigate these risks, having COVID-19 travel insurance is crucial to ensure you are protected in case of any unforeseen circumstances.

Importance of COVID-19 Travel Insurance

COVID-19 travel insurance provides coverage for medical expenses, trip cancellations, and emergency evacuations related to the virus. This can offer peace of mind and financial protection during your travels, especially in uncertain times.

What COVID-19 Travel Insurance Covers

- Medical expenses related to COVID-19 treatment

- Trip cancellations or interruptions due to COVID-19

- Emergency medical transportation if infected with COVID-19

- Coverage for quarantine expenses

Benefits of Purchasing COVID-19 Travel Insurance

By purchasing COVID-19 travel insurance, you can travel with confidence knowing that you are financially protected in case of any COVID-19 related emergencies. It provides a safety net and ensures that you are not left stranded or facing hefty medical bills while abroad.

Situations Where COVID-19 Travel Insurance is Beneficial

- If you contract COVID-19 while traveling and require medical treatment

- In the event of trip cancellations due to COVID-19 restrictions

- If you need to be evacuated back home for medical reasons related to COVID-19

- When facing unexpected quarantine expenses during your trip

Types of COVID-19 Travel Insurance

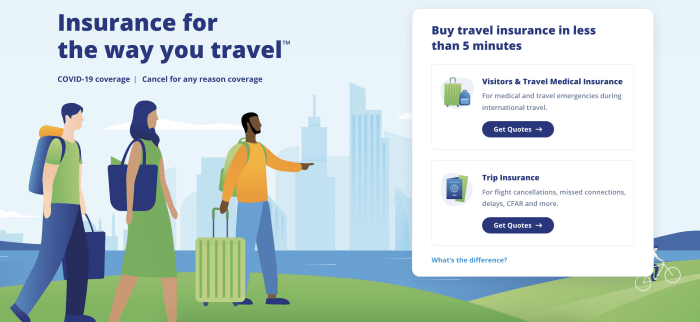

When it comes to COVID-19 travel insurance, there are several types available to cater to different needs and preferences. Let's explore the various options to help you make an informed decision.

Single-Trip COVID-19 Insurance vs. Annual COVID-19 Insurance

Single-trip COVID-19 insurance is designed for individuals who are planning a one-time trip and need coverage specifically for that journey. On the other hand, annual COVID-19 insurance provides coverage for multiple trips within a year, making it a cost-effective option for frequent travelers.

Coverage Limits and Restrictions

- COVID-19 travel insurance policies typically cover expenses related to COVID-19 testing, treatment, and medical evacuation.

- Some policies may also include coverage for trip cancellations or interruptions due to the pandemic.

- It's important to note that coverage limits and restrictions vary between insurance providers, so be sure to carefully review the policy details.

Specialized COVID-19 Insurance for Seniors or Individuals with Pre-existing Conditions

Seniors and individuals with pre-existing conditions may opt for specialized COVID-19 insurance that offers tailored coverage to meet their specific health needs. These policies may include additional benefits such as coverage for pre-existing conditions related to COVID-19.

Selecting the Right COVID-19 Travel Insurance

When it comes to choosing COVID-19 travel insurance, there are several key factors to consider to ensure you have the right coverage for your trip. From comparing insurance plans to finding affordable options and reading the fine print, making an informed decision is essential to protect yourself during your travels.

Key Factors to Consider When Choosing COVID-19 Travel Insurance

- Coverage for COVID-19 related medical expenses

- Coverage for trip cancellation or interruption due to COVID-19

- Repatriation coverage in case of a medical emergency

- 24/7 assistance and support services

Process of Comparing COVID-19 Insurance Plans

- Compare coverage limits and exclusions

- Check if COVID-19 testing and quarantine expenses are covered

- Look for policies with a high coverage limit for emergency medical expenses

Tips for Finding Affordable Yet Comprehensive COVID-19 Travel Insurance

- Consider purchasing insurance through a third-party provider for better rates

- Opt for a policy with a higher deductible to lower premiums

- Review and compare quotes from multiple insurance companies

Importance of Reading the Fine Print of COVID-19 Insurance Policies

- Understand coverage limitations and exclusions

- Be aware of any pre-existing conditions that may affect coverage

- Know the process for filing claims and any documentation required

Claims and Coverage

When it comes to COVID-19 travel insurance, understanding the claims process and coverage is crucial for travelers. This section will delve into the details of filing a claim, common exclusions, situations where claims may be denied, and steps to take in case of a COVID-19-related emergency during travel.

Filing a COVID-19 Travel Insurance Claim

- Notify your insurance provider immediately about the incident or illness.

- Complete the required claim forms accurately and provide all necessary documentation.

- Submit medical reports, receipts, and any other relevant information to support your claim.

- Follow up with the insurance company on the status of your claim and provide any additional information if requested.

Common Exclusions in COVID-19 Insurance Coverage

- Pre-existing medical conditions not disclosed at the time of purchasing the insurance.

- Traveling to high-risk destinations or countries with travel advisories in place.

- Engaging in activities that are not covered by the policy, such as extreme sports or illegal activities.

- Failure to adhere to government regulations or travel restrictions related to COVID-19.

Examples of Denied COVID-19 Insurance Claims

- A traveler tests positive for COVID-19 before departure but still attempts to travel.

- Seeking medical treatment for COVID-19 without prior approval from the insurance provider.

- Failing to provide accurate information or documentation to support the claim.

- Traveling to a destination with a known COVID-19 outbreak against travel advisories.

Steps in a COVID-19 Emergency During Travel

- Seek medical help immediately if experiencing COVID-19 symptoms.

- Contact your insurance provider as soon as possible to understand coverage and next steps.

- Follow local health guidelines and regulations for testing, quarantine, and treatment.

- Keep all receipts, medical reports, and documentation for the insurance claim process.

Final Summary

As we conclude this insightful discussion on COVID-19 travel insurance, remember to stay informed, compare plans wisely, and always be prepared for any travel emergencies that may arise. Safe travels!

Popular Questions

What does COVID-19 travel insurance cover?

COVID-19 travel insurance typically covers medical expenses, trip cancellations due to COVID-19, and emergency medical evacuation related to the virus.

How do I compare different COVID-19 insurance plans?

When comparing plans, look at coverage limits, exclusions, premiums, and whether COVID-19 testing and treatment are included.

Can COVID-19 insurance claims be denied?

Claims may be denied if the policyholder travels to a destination with a travel advisory against it or if they fail to follow safety guidelines.