In the realm of travel insurance, the importance of COVID cover cannot be overstated. With the unpredictable nature of the pandemic, having adequate protection while traveling is paramount. This guide delves into the nuances of travel insurance COVID cover, shedding light on its significance and how it can safeguard travelers in these uncertain times.

Delving deeper, we explore the various types of COVID coverage available, the limitations and exclusions to be mindful of, and provide insights on selecting the right travel insurance policy that offers comprehensive COVID protection.

Importance of Travel Insurance COVID Cover

Travel insurance with COVID cover has become essential in today's uncertain times. It provides travelers with protection and peace of mind knowing that they are covered in case of any unexpected events related to the pandemic.

Protection Against Trip Cancellations and Interruptions

Travel insurance with COVID cover can protect travelers from financial losses due to trip cancellations or interruptions caused by the pandemic. This coverage can reimburse travelers for non-refundable expenses such as flights, accommodations, and tours if their trip is disrupted due to COVID-related reasons.

Emergency Medical Coverage

Having travel insurance with COVID cover ensures that travelers have access to emergency medical coverage if they contract the virus while traveling. This coverage can help cover medical expenses, hospitalization costs, and emergency medical evacuation if needed, providing travelers with much-needed support during a health crisis.

Quarantine Accommodation and Expenses

In case travelers are required to quarantine due to exposure to COVID-19 while traveling, having travel insurance with COVID cover can help cover the costs of quarantine accommodation and daily expenses. This can alleviate the financial burden of unexpected quarantine requirements and ensure that travelers have a safe and comfortable place to stay during isolation.

Peace of Mind and Financial Protection

Overall, travel insurance with COVID cover offers travelers peace of mind and financial protection during these uncertain times. It allows travelers to focus on enjoying their trip without worrying about the potential risks and expenses associated with the pandemic, making it a valuable investment for anyone planning to travel in the current environment.

Types of COVID Coverage in Travel Insurance

Travel insurance policies offer various types of COVID coverage to protect travelers during these uncertain times. Let's explore the differences between basic travel insurance and travel insurance with COVID cover, as well as specific COVID-related coverage options available.

COVID Testing Coverage

Some travel insurance plans provide coverage for COVID testing expenses, including pre-departure testing requirements and testing during your trip. This coverage can help alleviate the financial burden of testing while traveling.

Trip Cancellation or Interruption Due to COVID

Travel insurance with COVID cover typically includes benefits for trip cancellation or interruption due to COVID-related reasons, such as testing positive for the virus before your trip or being denied boarding due to a fever.

Emergency Medical Treatment for COVID

In the event that you contract COVID while traveling, some travel insurance policies may cover emergency medical treatment for the virus. This can include hospital stays, doctor visits, and other necessary medical expenses related to COVID.

Quarantine Accommodation Coverage

If you are required to quarantine due to exposure to COVID while traveling, certain travel insurance plans may cover the cost of accommodation during your quarantine period. This coverage can help ease the financial burden of unexpected extended stays.

Travel Delay Due to COVID

Travel insurance with COVID cover may also include benefits for travel delays caused by COVID-related reasons, such as flight cancellations due to the pandemic. This coverage can provide reimbursement for additional expenses incurred during the delay.

Repatriation Coverage

In the unfortunate event of a traveler passing away due to COVID while abroad, some travel insurance policies offer repatriation coverage. This coverage assists with the costs associated with returning the deceased traveler's remains to their home country.

Coverage Limitations and Exclusions

Travel insurance policies that provide coverage for COVID-19 may come with certain limitations and exclusions that travelers should be aware of. These limitations and exclusions can affect the extent of coverage and eligibility for certain claims related to the pandemic.

Pre-Existing Medical Conditions

- Most travel insurance policies do not cover claims related to pre-existing medical conditions, including those exacerbated by COVID-19.

- Travelers with pre-existing conditions should carefully review the policy terms to understand if their condition is excluded from coverage.

Travel to High-Risk Destinations

- Some insurance providers may exclude coverage for travel to destinations deemed high-risk for COVID-19 by health authorities.

- Travelers should check if their destination is on the insurer's list of excluded locations to avoid claim denials.

Failure to Follow Health Guidelines

- If a traveler fails to adhere to recommended health guidelines or government regulations related to COVID-19, their claim may be denied.

- Non-compliance with mask mandates, testing requirements, or quarantine protocols could result in coverage exclusions.

Cancellation Due to Fear or Anxiety

- Some policies may not cover trip cancellations due to fear or anxiety about traveling during the pandemic.

- Coverage is typically limited to specific reasons Artikeld in the policy, such as illness or travel restrictions.

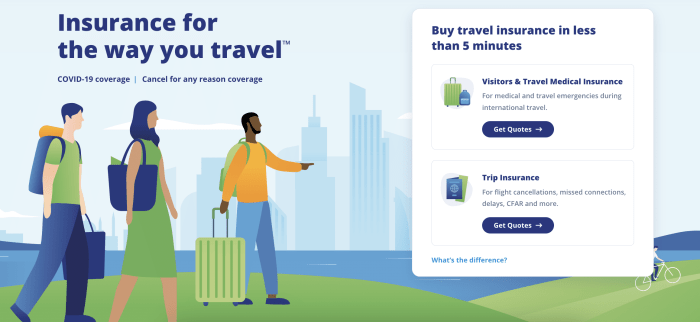

How to Choose the Right Travel Insurance with COVID Cover

When selecting a travel insurance policy with COVID coverage, there are several key factors to consider to ensure you get the best protection for your trip. Here is a step-by-step guide to help you evaluate and choose the right travel insurance with COVID cover.

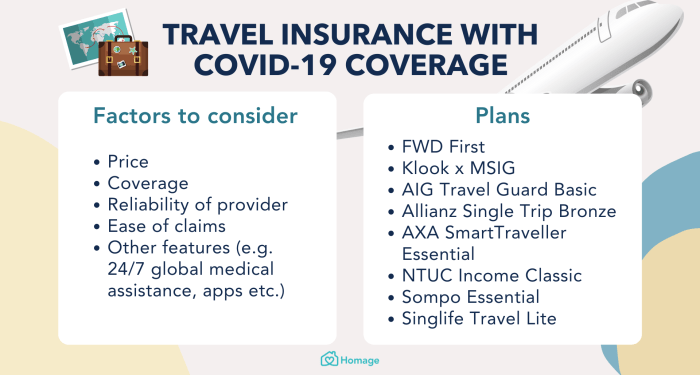

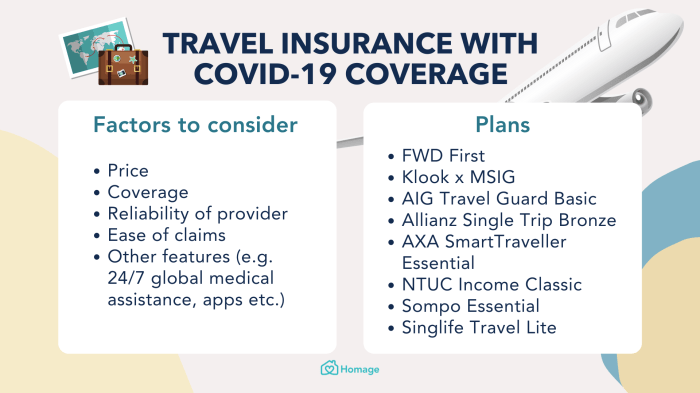

Factors to Consider When Selecting a Travel Insurance Policy with COVID Coverage

- Check the coverage limits for COVID-related expenses, including medical treatment, quarantine costs, and trip cancellation due to COVID.

- Look for a policy that includes coverage for COVID-related trip interruptions, such as flight cancellations or delays.

- Consider the availability of emergency assistance services for COVID-related issues while traveling.

- Check if the policy covers pre-existing medical conditions that may be exacerbated by COVID.

- Evaluate the exclusions and limitations of the policy to understand what is not covered.

Comparison of Different Insurance Providers Offering COVID Cover for Travelers

- Research and compare insurance providers that offer comprehensive COVID coverage tailored to your travel needs.

- Read reviews and ratings from other travelers to gauge the reliability and customer service of the insurance providers.

- Compare premiums, deductibles, and coverage limits to find the best value for your money.

- Consider the reputation and financial stability of the insurance company to ensure they can fulfill their obligations in case of a claim.

Step-by-Step Guide on How to Evaluate and Choose the Best Travel Insurance with COVID Protection

- Assess your travel needs and destination requirements to determine the level of coverage you need.

- Obtain quotes from multiple insurance providers and compare their COVID coverage benefits and terms.

- Review the policy documents carefully, paying attention to the fine print, coverage exclusions, and limitations.

- Contact the insurance company directly to clarify any doubts or questions you may have regarding the COVID coverage.

- Select the travel insurance policy that offers the most comprehensive COVID protection within your budget and purchase it before your trip.

Final Wrap-Up

As we wrap up this discussion on travel insurance COVID cover, it becomes evident that being well-prepared is key to a worry-free travel experience. By understanding the intricacies of COVID coverage in travel insurance, travelers can embark on their journeys with confidence, knowing they are adequately protected against unforeseen circumstances.

FAQs

What does travel insurance COVID cover include?

Travel insurance COVID cover typically includes coverage for trip cancellations due to COVID-related reasons, medical expenses if you contract COVID while traveling, and emergency medical evacuation if needed.

Are there limitations to COVID coverage in travel insurance?

Yes, common limitations may include pre-existing conditions related to COVID, government travel advisories, and cancellations due to fear of traveling during the pandemic.

How do I choose the right travel insurance with COVID cover?

Consider factors like coverage limits, medical coverage, trip cancellation benefits, and the reputation of the insurance provider. Compare different options and read the policy details carefully before making a decision.