Embark on a journey into the world of multi trip travel insurance, where convenience meets peace of mind. This comprehensive coverage option offers travelers a hassle-free experience with added flexibility and savings. Let's delve deeper into the realm of multi trip travel insurance and discover why it's the smart choice for frequent adventurers.

As we navigate through the intricacies of multi trip travel insurance, we'll uncover its advantages, coverage details, and essential tips for a seamless claims process. Get ready to explore a new dimension of travel protection tailored to meet the needs of modern globetrotters.

What is Multi Trip Travel Insurance?

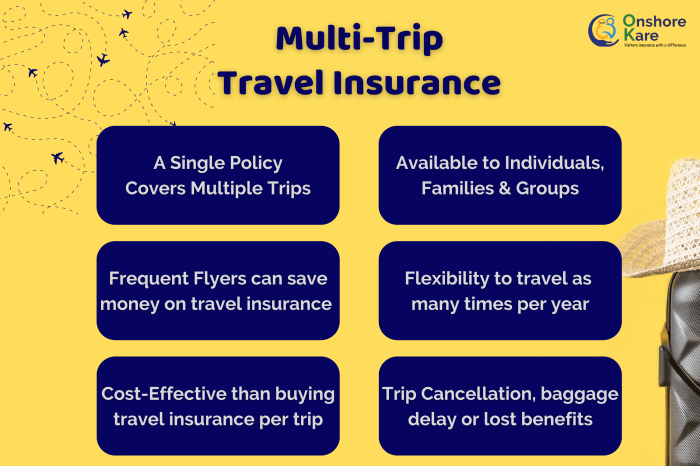

Multi Trip Travel Insurance, also known as Annual Travel Insurance, is a type of travel insurance policy that covers an individual for multiple trips within a specified period, usually one year. Unlike single trip insurance, which only covers a specific trip, multi trip insurance offers coverage for an unlimited number of trips during the policy period.

Benefits of Multi Trip Travel Insurance

- Cost-effective: Instead of purchasing separate insurance policies for each trip, multi trip insurance provides coverage for all trips taken within the year, saving money in the long run.

- Convenience: With multi trip insurance, travelers do not have to worry about purchasing insurance every time they plan a trip, making it convenient and hassle-free.

- Continuous coverage: Multi trip insurance ensures travelers are protected for all trips taken within the policy period, eliminating the need to arrange insurance every time they travel.

Typical Coverage Offered Under Multi Trip Travel Insurance

- Medical expenses: Coverage for emergency medical expenses incurred during a trip, including hospitalization, medication, and emergency medical evacuation.

- Trip cancellation and interruption: Reimbursement for non-refundable trip costs in case of trip cancellation or interruption due to covered reasons such as illness, injury, or natural disasters.

- Baggage and personal belongings: Compensation for lost, stolen, or damaged baggage and personal belongings during a trip.

- Travel delay: Coverage for additional expenses incurred due to travel delays, such as accommodation and meals.

- Emergency assistance: 24/7 access to emergency assistance services, including medical referrals, legal assistance, and travel assistance.

Factors to Consider When Choosing Multi Trip Travel Insurance

When selecting a multi trip travel insurance plan, there are several key factors that travelers should carefully consider to ensure they are adequately covered during their travels. These factors can vary depending on individual needs and preferences, so it's essential to evaluate them thoroughly before making a decision.

Coverage Limits

Coverage limits refer to the maximum amount of money an insurance company will pay out for a specific type of claim. It is crucial to consider the coverage limits of a multi trip travel insurance policy to ensure that it adequately covers all potential expenses that may arise during your trips.

Be sure to check the limits for medical expenses, trip cancellations, baggage loss, and other common travel-related issues.

Deductibles

Deductibles are the out-of-pocket expenses that the insured individual must pay before the insurance company starts covering the remaining costs. When choosing a multi trip travel insurance plan, consider the deductibles associated with different types of claims. A lower deductible may result in higher premiums, while a higher deductible can lower your premium costs.

Evaluate your risk tolerance and financial situation to determine the most suitable deductible for your needs.

Exclusions

Exclusions are specific situations or events that are not covered by the insurance policy. Understanding the exclusions in a multi trip travel insurance plan is crucial to avoid any surprises when making a claim. Common exclusions may include pre-existing medical conditions, high-risk activities, or travel to certain countries or regions.

Carefully review the policy exclusions to ensure that you are aware of any limitations or restrictions.

Comparing Policies

When comparing different multi trip travel insurance policies available in the market, it's essential to consider not only the price but also the coverage, limits, deductibles, and exclusions. Look for policies that offer comprehensive coverage for a wide range of travel-related risks and emergencies.

Consider the reputation and financial stability of the insurance company to ensure that they can provide reliable assistance when needed. Take the time to read the fine print and ask questions to clarify any doubts before making a decision.

Coverage Details of Multi Trip Travel Insurance

Multi trip travel insurance provides coverage for frequent travelers who go on multiple trips within a year. This type of insurance offers protection for various travel-related risks such as trip cancellations, medical emergencies, lost baggage, and more. Let's explore the breakdown of coverage typically included in multi trip travel insurance.

Types of Coverage Offered

- Trip Cancellation and Interruption: This coverage reimburses you for prepaid and non-refundable trip expenses if you have to cancel or cut short your trip due to covered reasons such as illness, injury, or other unforeseen events.

- Emergency Medical and Dental: This coverage pays for medical and dental expenses incurred during your trip, including hospital stays, surgeries, and prescription medications.

- Baggage Loss and Delay: It provides reimbursement for lost, stolen, or damaged baggage, as well as compensation for essential items in case of baggage delay.

- Travel Delay: If your trip is delayed due to reasons beyond your control, this coverage helps cover additional expenses such as accommodations, meals, and transportation.

- Emergency Evacuation and Repatriation: In case of a medical emergency or natural disaster, this coverage arranges and covers the cost of emergency evacuation to the nearest adequate medical facility or your home country.

Optional Add-On Coverage

- Adventure Sports Coverage: This add-on extends coverage to high-risk adventure activities such as skydiving, scuba diving, or mountaineering.

- Rental Car Collision Coverage: It provides protection against damages to rental vehicles during your trip.

- Cancel for Any Reason: This optional coverage allows you to cancel your trip for any reason not covered under the standard policy, providing more flexibility and peace of mind.

- Missed Connection: Covers expenses incurred due to missed connecting flights or transportation due to delays or cancellations.

Tips for Making a Claim with Multi Trip Travel Insurance

When it comes to filing a claim under a multi trip travel insurance policy, there are certain steps you need to follow to ensure a smooth and successful process. It's important to know how to document incidents, gather evidence, and avoid common pitfalls when making a claim.

Here are some tips to help you navigate the claims process effectively.

Step-by-Step Process for Filing a Claim

- Notify your insurance provider: Contact your insurance company as soon as possible after the incident occurs to report the claim.

- Fill out the claim form: Your insurer will provide you with a claim form that you need to complete with all the relevant details.

- Submit supporting documents: Along with the claim form, you may need to provide supporting documents such as police reports, medical records, or receipts.

- Cooperate with the investigation: Your insurer may conduct an investigation to verify the details of your claim, so it's important to cooperate fully.

- Wait for a decision: Once all the necessary information has been submitted, your insurer will review your claim and make a decision on whether to approve it.

- Receive payment: If your claim is approved, you will receive payment for the covered expenses according to your policy terms.

Best Practices for Documenting Incidents and Gathering Evidence

- Take photos: If possible, take photos of the incident and any damage or injuries for documentation purposes.

- Keep receipts: Save all receipts related to your claim, such as medical bills, hotel expenses, or transportation costs.

- Get witness statements: If there were witnesses to the incident, try to get their contact information and statements to support your claim.

- Report incidents promptly: Don't delay in reporting the incident to your insurer, as timely reporting can help expedite the claims process.

Common Pitfalls to Avoid When Filing a Claim

- Providing incomplete information: Make sure to fill out the claim form accurately and completely to avoid delays or denials.

- Missing deadlines: Be aware of any deadlines for filing a claim and submitting supporting documents to avoid missing out on coverage.

- Exaggerating or falsifying claims: Always be honest and truthful when submitting a claim to avoid potential legal consequences.

- Not following up: Stay in communication with your insurer and provide any additional information or documentation they may request.

Epilogue

In conclusion, multi trip travel insurance emerges as the ideal companion for jet setters seeking comprehensive coverage and convenience. By opting for this versatile policy, travelers can embark on their adventures with confidence, knowing they are well-protected every step of the way.

Make the smart choice today and elevate your travel experience with multi trip travel insurance.

FAQ Corner

What is the advantage of multi trip travel insurance over single trip insurance?

Multi trip travel insurance offers continuous coverage for an entire year, allowing frequent travelers to save time and money compared to purchasing separate policies for each trip.

What factors should travelers consider when selecting a multi trip travel insurance plan?

Travelers should pay attention to coverage limits, deductibles, exclusions, and the specific needs of their travel habits to choose the most suitable multi trip travel insurance plan.

How can travelers make a claim with multi trip travel insurance?

Travelers can initiate a claim by following the step-by-step process Artikeld in their policy, documenting incidents thoroughly, and avoiding common pitfalls that may delay the claim process.