Income travel insurance opens the door to a world of possibilities for travelers, offering a safety net that ensures peace of mind during trips. This comprehensive guide delves into the nuances of income travel insurance, shedding light on its importance and key features with a focus on providing valuable insights to readers.

As we navigate through the different aspects of income travel insurance, we aim to equip you with the knowledge needed to make informed decisions when planning your next adventure.

Introduction to Income Travel Insurance

![NTUC Income Travel Insurance Review | [2025] Dollar Bureau NTUC Income Travel Insurance Review | [2025] Dollar Bureau](https://technology.compleatthought.com/wp-content/uploads/2025/12/COVID-19-Enhancement-website-version.jpg)

Income travel insurance is a type of insurance that provides coverage for loss of income due to unexpected events while traveling. It is designed to protect travelers from financial losses that may arise from situations such as trip cancellations, medical emergencies, or travel delays.

Importance of Income Travel Insurance

Income travel insurance is important for travelers as it offers financial protection and peace of mind during their trips. In the event of unforeseen circumstances that impact your ability to work or generate income while traveling, this type of insurance can provide a safety net to cover lost earnings.

- Income Protection: Income travel insurance ensures that you are financially secure in case you are unable to work due to an unexpected event during your trip.

- Peace of Mind: Knowing that you have coverage for potential loss of income can alleviate stress and allow you to enjoy your travels without worrying about financial setbacks.

- Emergency Assistance: Income travel insurance often includes access to emergency assistance services, such as medical referrals or travel arrangements, to help you navigate unexpected situations while traveling.

Examples of Situations Where Income Travel Insurance Can Be Beneficial

Income travel insurance can be beneficial in scenarios such as:

- Illness or Injury: If you fall ill or get injured during your trip and are unable to work, income travel insurance can provide financial support.

- Flight Delays: In the case of significant flight delays that impact your work schedule, income travel insurance can help cover the resulting income loss.

- Family Emergencies: Should you need to cut your trip short due to a family emergency, income travel insurance can offer compensation for the income you would have earned if you were not forced to return home.

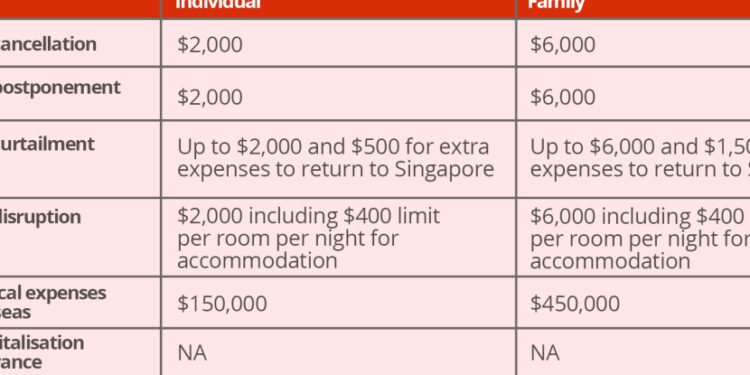

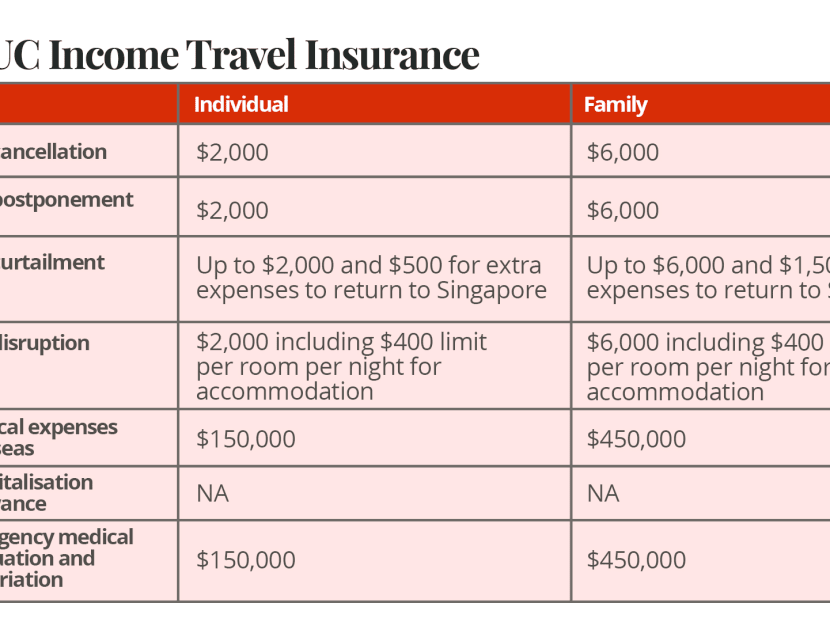

Key Features of Income Travel Insurance Policies

Income travel insurance policies typically include the following key features:

- Income Replacement: Coverage for lost income due to unexpected events during travel.

- Medical Coverage: Reimbursement for medical expenses incurred while traveling.

- Trip Cancellation: Compensation for non-refundable trip expenses in case of trip cancellation.

- Emergency Assistance: Access to 24/7 emergency assistance services for travel-related emergencies.

Coverage Offered by Income Travel Insurance

Income travel insurance typically includes coverage for a variety of situations that travelers may encounter during their trips. This type of insurance is designed to provide financial protection and assistance in case of unexpected events while traveling.

Types of Coverage Included

- Medical Expenses: Income travel insurance often covers medical expenses incurred due to illness or injury during the trip.

- Trip Cancellation or Interruption: Coverage may apply if the trip needs to be canceled or cut short due to unforeseen circumstances such as illness, natural disasters, or other emergencies.

- Lost or Delayed Baggage: Insurance can help reimburse expenses related to lost or delayed baggage during the journey.

- Emergency Evacuation: In case of a medical emergency or any other crisis, income travel insurance may cover the costs of emergency evacuation.

Scenarios Where Coverage Applies

- If a traveler falls ill during their trip and requires medical attention, income travel insurance can help cover the medical expenses.

- In the event of a natural disaster or unexpected political unrest that forces the traveler to cancel their trip, insurance can provide reimbursement for prepaid expenses.

- If luggage is lost or delayed during transit, income travel insurance can assist in reimbursing the traveler for necessary purchases or replacement items.

Comparison with Regular Travel Insurance

Income travel insurance often offers more comprehensive coverage compared to regular travel insurance. While both types of insurance provide basic coverage for medical emergencies and trip cancellations, income travel insurance may include additional benefits such as coverage for lost or delayed baggage, emergency evacuation, and other specific scenarios.

Additionally, income travel insurance may have higher coverage limits and more tailored benefits for frequent travelers or those with specific needs.

Eligibility and Requirements

When it comes to purchasing Income Travel Insurance, there are specific eligibility criteria and requirements that travelers need to meet in order to qualify for coverage.

Eligibility Criteria

- Travelers must be residents of the country where the policy is being purchased.

- Age restrictions may apply, with some policies only covering individuals within a certain age range.

- Travelers with pre-existing medical conditions may need to disclose these to the insurance provider.

Specific Requirements

- Travelers may need to provide proof of their travel itinerary, including flight details and accommodations.

- Some policies require travelers to purchase insurance within a certain timeframe before their trip.

- Certain risky activities, such as extreme sports, may require additional coverage and premiums.

Impact of Income Level and Occupation

Income level and occupation may impact eligibility for Income Travel Insurance in the following ways:

- Some policies may have income restrictions, with coverage varying based on the individual's income level.

- Occupations that are considered high-risk may require specialized coverage or higher premiums.

- Certain occupations, such as military personnel or professional athletes, may have specific requirements or limitations when it comes to travel insurance.

Benefits and Drawbacks

When considering income travel insurance, there are several benefits and drawbacks to keep in mind. Understanding these can help you make an informed decision before your next trip.

Benefits of Income Travel Insurance

- Medical Coverage: Income travel insurance typically provides coverage for medical emergencies while abroad, including hospital stays, doctor visits, and prescription medications.

- Trip Cancellation: Many policies offer reimbursement for non-refundable expenses in case you need to cancel your trip due to unforeseen circumstances like illness or natural disasters.

- Baggage Loss: If your baggage is lost or delayed during your travels, income travel insurance can provide compensation for the items you need to replace.

- Emergency Assistance: Most policies include 24/7 emergency assistance services to help you navigate unexpected situations in a foreign country.

Drawbacks of Income Travel Insurance

- Cost: Income travel insurance can add to the overall cost of your trip, especially if you opt for additional coverage beyond the basic policy.

- Coverage Limitations: Some policies may have limitations on coverage amounts or specific exclusions that could leave you vulnerable in certain situations.

- Pre-Existing Conditions: Pre-existing medical conditions may not be covered under income travel insurance unless specified in the policy, which could be a drawback for some travelers.

- Claim Process: The process of filing a claim and receiving reimbursement can sometimes be complex and time-consuming, leading to potential frustrations for policyholders.

Scenarios where Benefits Outweigh Drawbacks

In scenarios where travelers have pre-existing medical conditions or are embarking on an expensive trip, the benefits of income travel insurance can outweigh the drawbacks. For example, if a traveler with a pre-existing condition requires emergency medical attention while abroad, having insurance coverage can provide peace of mind and financial protection.

Similarly, if a traveler has invested a significant amount in a trip and needs to cancel last minute, the reimbursement provided by the insurance policy can offset the financial loss. Overall, the benefits of income travel insurance can prove invaluable in ensuring a smooth and worry-free travel experience.

Final Summary

In conclusion, income travel insurance emerges as a valuable asset for travelers, offering a sense of security and protection that can prove invaluable during unforeseen circumstances. By understanding the benefits and considerations associated with income travel insurance, you can embark on your journeys with confidence and peace of mind.

FAQ Corner

What is income travel insurance?

Income travel insurance is a specialized type of insurance that provides coverage for loss of income due to unexpected events during travel.

Who is eligible for income travel insurance?

The eligibility criteria for income travel insurance typically depend on factors such as occupation, income level, and age.

What are the benefits of income travel insurance?

Income travel insurance offers financial protection in case of trip cancellations, medical emergencies, or other unforeseen events that may impact your income.

Are there any drawbacks to income travel insurance?

Some limitations of income travel insurance may include restrictions on coverage for pre-existing conditions or specific types of travel incidents.